APY Calculator

Calculate the annual percentage yield using our APY calculator.

APY:

| Future Value: | $ |

| Total Interest: | $ |

On this page:

How to Calculate Annual Percentage Yield

Annual Percentage Yield (APY) is the interest rate that is calculated once compounding is in effect. The more frequent the compounding of an interest rate, the higher the total interest will be.

Compound interest is interest that is calculated on the initial principal and also the accumulated interest of an investment or loan.

While interest can technically be compounded at any time frequency, the most common frequencies are daily, monthly, quarterly, semiannually, and annually. These are also the available frequencies in the APY calculator.

Since interest will be higher with more frequent compounding, interest will be highest under daily compounding and lowest under annual compounding. We show this in the examples below.

The Effective Annual Rate (EAR) will give you the same interest rate as the APY. The EAR calculator is the same as the APY calculator with one exception: The EAR calculator does not have an option to enter an initial value or term.

When calculating EAR or APY, the only variables needed are the interest rate and the number of times interest is compounded per year. (The APY calculator also has an option to enter an initial value and term in years.)

The interest that is calculated using the APY calculator will be the same amount calculated using the compound interest calculator when no annual contributions are included.

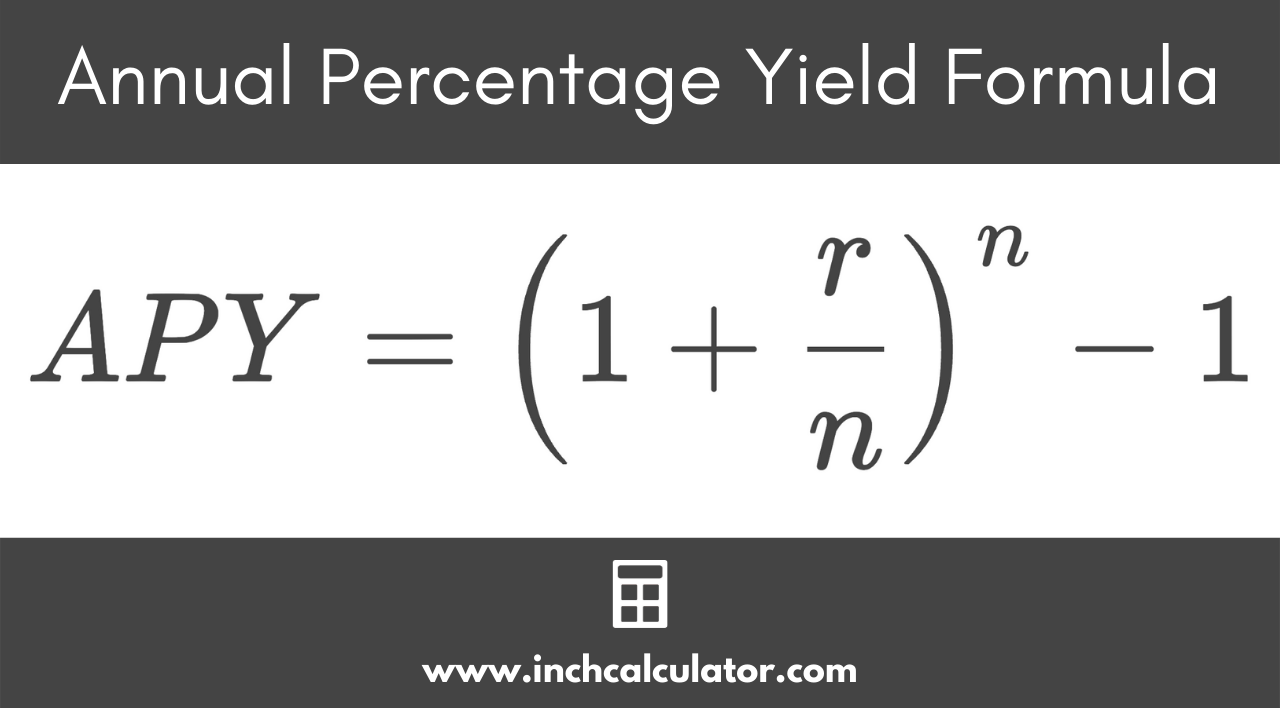

APY Formula

You can calculate APY by adding 1 to the division of the interest rate by the number of compounding periods in a year, raised to the power of the number of compounding periods in a year, and subtracting 1. Let’s show this formulaically and then numerically:

The annual percentage yield formula is:

Where:

r = interest rate

n = number of times interest is compounded per year

For example, let’s see what the APY will be using a few different compounding periods for an interest rate of 5% for 7 years by plugging these numbers into the APY formula. The total interest and future value are shown for an initial investment of $1,000.

Monthly compounded (n = 12)

Total interest = $418.04

Future Value = $1,418.04

Semiannually compounded (n = 2)

Total interest = $412.97

Future Value = $1,412.97

There are a few key takeaways from these examples:

- The APY correlates directly to n (the number of times interest is compounded per year). A lower n equals a lower APY.

- The annually compounded APY is equal to the interest rate because the interest rate wasn’t compounded during the year and is only compounded at the end of the year.

How is APY Different from the Interest Rate?

The APY allows interest rates to be compared to each other even if the frequencies aren’t the same. APY will also be different from an interest rate for all compounding periods, except annual compounding.

In all other compounding frequencies, the interest rate will compound at some point during the year. The more times an interest rate has been compounded during the year, the higher the APY will be.

Also, the more frequent the compounding, the higher the total interest will be. If the interest rate is also higher, the total interest will be higher as well.

You can think of the interest rate as a simple interest rate where there is no compounding. However, the APY is the compounded interest rate and cannot be compared directly to the interest rate to decide between different investments or loan opportunities.

In fact, interest rates of different compounding frequencies cannot even be compared to each other. How can you tell if a 3% interest rate compounded daily is higher or lower than a 3.04% interest rate compounded annually? You can’t tell for sure until you know what the APY is.

If you were to enter both the 3% daily compounded interest rate and the 3.04% annually compounded interest rate into the APY calculator, you will see that the 3% daily compounded interest rate leads to a slightly higher APY and total interest.

You can use our interest calculator to compare the difference in interest over time when using simple interest vs. compound interest.

APR vs. APY

APR stands for Annual Percentage Rate. The APR interest rate is closer to the simple interest rate with one twist. It includes other fees that the bank may charge you, such as financing fees and prepaid fees. The APR represents the true cost of borrowing money if the loan is a simple interest loan.

If you’re taking out a loan with a relatively high interest rate but low fees, then you may end up with a lower APR than a loan with a low interest rate but high fees. This is why most experts suggest comparing the APR between two financial institutions or loans rather than only comparing the interest rates.

You can use our APR calculator to quickly compare the rates on loans.

APR and APY are similar in that they both annualize the interest rate (and why they both have “annual” in their names).

However, APR and APY differ in several ways:

- The APY takes compounding into consideration, but the APR does not. The APR more accurately represents the cost of borrowing for a loan because most loans use simple interest. The APY more accurately represents the return on investment for a savings account or CD because the bank will pay you compound interest (interest on the principal balance and previously accrued interest).

- The APR includes additional fees that the financial institution may charge on top of the interest rate, whereas the APY only includes the interest rate.

Our APR to APY calculator shows the comparison from the compound to simple interest rate.

The Power of Compounding Interest

Compound interest may be the most significant factor in finance. It is rumored that Albert Einstein said that compound interest is mankind’s greatest invention and the eighth wonder of the world.

Compound growth has enabled many people to retire at earlier ages. Very few people can retire by parking their money in a bank account earning almost no interest. Higher growth investments would be stocks, bonds, and real estate.

Compound interest allows you to earn money on your earnings in an investment. And the longer you keep your money in the investment, the more you can expect to accumulate, which is why you often hear the best time to start investing is now.

For example, we will compare the difference between what two individuals earned on their money. The first individual invested $100,000 for 30 years at an average of 8% interest compounding annually. The second individual also invested $100,000 at 8% but only for 15 years.

When we plug these numbers into the APY calculator, we see that the first individual ended up with over $1 million and slightly over $900,000 in interest earned. The second individual only ended up with $317,217 with only $217,217 in interest.

By investing twice as long as the second investor, the first individual earned over four times the interest. This is the power of compound interest going to work for you.

An interest rate is a function of its risk characteristics, so a higher interest rate is a more risky investment. Starting an investment earlier is less risky and requires less of an original investment when your investment includes compound interest.

Frequently Asked Questions

What does APY mean?

APY is the annual percentage yield, or the percentage that shows the total interest that will be paid, taking into account compound interest, based on an investment or loan over a period of one year.

Is a high APY rate good?

Depending on whether you are investing or borrowing money will determine whether a high APY rate is good.

If you are investing, then the higher the APY rate the better. However, if you are borrowing money, you will want the lowest APY rate because this means you will be paying the lowest amount in interest.

Is APY better than APR?

APR more accurately represents the cost of borrowing for a loan because most loans use simple interest. It also includes any additional fees that may be charged to a borrower. Whereas APY takes into account compounding and only accounts for the interest rate.

If you are borrowing a loan with simple interest, APR may be a more accurate depiction of how much you will be paying for the loan.

However, if you are investing money, APY may be a more accurate depiction of what you can expect to earn since it takes into account compounding, which can make a significant difference on the total interest earned.