ATV Loan Calculator

Use our loan calculator to determine the payment for an ATV.

Loan Summary:

| Monthly Payment: | $200.04

|

| Loan Amount: | $10,600.00

|

| Total Interest: | $1,402.03

|

| Total Payments: | $12,002.03

|

| Payoff Date: | May 2030

|

Amortization Schedule:

| Date | Payment | Principal | Interest | Remaining Balance |

|---|---|---|---|---|

| May 2025 | $200.04 | $155.87 | $44.17 | $10,444.13 |

| Jun 2025 | $200.04 | $156.52 | $43.52 | $10,287.61 |

| Jul 2025 | $200.04 | $157.17 | $42.87 | $10,130.44 |

| Aug 2025 | $200.04 | $157.83 | $42.21 | $9,972.61 |

| Sep 2025 | $200.04 | $158.49 | $41.55 | $9,814.12 |

| Oct 2025 | $200.04 | $159.15 | $40.89 | $9,654.97 |

| Nov 2025 | $200.04 | $159.81 | $40.23 | $9,495.16 |

| Dec 2025 | $200.04 | $160.48 | $39.56 | $9,334.68 |

| Jan 2026 | $200.04 | $161.15 | $38.89 | $9,173.53 |

| Feb 2026 | $200.04 | $161.82 | $38.22 | $9,011.71 |

| Mar 2026 | $200.04 | $162.49 | $37.55 | $8,849.22 |

| Apr 2026 | $200.04 | $163.17 | $36.87 | $8,686.05 |

| May 2026 | $200.04 | $163.85 | $36.19 | $8,522.20 |

| Jun 2026 | $200.04 | $164.53 | $35.51 | $8,357.67 |

| Jul 2026 | $200.04 | $165.22 | $34.82 | $8,192.45 |

| Aug 2026 | $200.04 | $165.90 | $34.14 | $8,026.55 |

| Sep 2026 | $200.04 | $166.60 | $33.44 | $7,859.95 |

| Oct 2026 | $200.04 | $167.29 | $32.75 | $7,692.66 |

| Nov 2026 | $200.04 | $167.99 | $32.05 | $7,524.67 |

| Dec 2026 | $200.04 | $168.69 | $31.35 | $7,355.98 |

| Jan 2027 | $200.04 | $169.39 | $30.65 | $7,186.59 |

| Feb 2027 | $200.04 | $170.10 | $29.94 | $7,016.49 |

| Mar 2027 | $200.04 | $170.80 | $29.24 | $6,845.69 |

| Apr 2027 | $200.04 | $171.52 | $28.52 | $6,674.17 |

| May 2027 | $200.04 | $172.23 | $27.81 | $6,501.94 |

| Jun 2027 | $200.04 | $172.95 | $27.09 | $6,328.99 |

| Jul 2027 | $200.04 | $173.67 | $26.37 | $6,155.32 |

| Aug 2027 | $200.04 | $174.39 | $25.65 | $5,980.93 |

| Sep 2027 | $200.04 | $175.12 | $24.92 | $5,805.81 |

| Oct 2027 | $200.04 | $175.85 | $24.19 | $5,629.96 |

| Nov 2027 | $200.04 | $176.58 | $23.46 | $5,453.38 |

| Dec 2027 | $200.04 | $177.32 | $22.72 | $5,276.06 |

| Jan 2028 | $200.04 | $178.06 | $21.98 | $5,098.00 |

| Feb 2028 | $200.04 | $178.80 | $21.24 | $4,919.20 |

| Mar 2028 | $200.04 | $179.54 | $20.50 | $4,739.66 |

| Apr 2028 | $200.04 | $180.29 | $19.75 | $4,559.37 |

| May 2028 | $200.04 | $181.04 | $19.00 | $4,378.33 |

| Jun 2028 | $200.04 | $181.80 | $18.24 | $4,196.53 |

| Jul 2028 | $200.04 | $182.55 | $17.49 | $4,013.98 |

| Aug 2028 | $200.04 | $183.32 | $16.72 | $3,830.66 |

| Sep 2028 | $200.04 | $184.08 | $15.96 | $3,646.58 |

| Oct 2028 | $200.04 | $184.85 | $15.19 | $3,461.73 |

| Nov 2028 | $200.04 | $185.62 | $14.42 | $3,276.11 |

| Dec 2028 | $200.04 | $186.39 | $13.65 | $3,089.72 |

| Jan 2029 | $200.04 | $187.17 | $12.87 | $2,902.55 |

| Feb 2029 | $200.04 | $187.95 | $12.09 | $2,714.60 |

| Mar 2029 | $200.04 | $188.73 | $11.31 | $2,525.87 |

| Apr 2029 | $200.04 | $189.52 | $10.52 | $2,336.35 |

| May 2029 | $200.04 | $190.31 | $9.73 | $2,146.04 |

| Jun 2029 | $200.04 | $191.10 | $8.94 | $1,954.94 |

| Jul 2029 | $200.04 | $191.89 | $8.15 | $1,763.05 |

| Aug 2029 | $200.04 | $192.69 | $7.35 | $1,570.36 |

| Sep 2029 | $200.04 | $193.50 | $6.54 | $1,376.86 |

| Oct 2029 | $200.04 | $194.30 | $5.74 | $1,182.56 |

| Nov 2029 | $200.04 | $195.11 | $4.93 | $987.45 |

| Dec 2029 | $200.04 | $195.93 | $4.11 | $791.52 |

| Jan 2030 | $200.04 | $196.74 | $3.30 | $594.78 |

| Feb 2030 | $200.04 | $197.56 | $2.48 | $397.22 |

| Mar 2030 | $200.04 | $198.38 | $1.66 | $198.84 |

| Apr 2030 | $199.67 | $198.84 | $0.83 | $0.00 |

On this page:

How to Calculate the Payment for an ATV Loan

When you’re in the market for a new ATV, understanding how to calculate your loan payment is crucial. This not only helps you budget accordingly but also ensures you are not overextending your finances.

Three factors are used to determine the payment for an ATV loan: the loan amount, interest rate, and loan term. You can calculate the payment in a few steps.

Step One: Find the Loan Amount

The loan amount is the total amount of money you borrow from a lender to purchase the ATV, which can include the price of the machine itself, accessories, taxes, and lending fees. You can reduce the loan amount by making a down payment, trading in a used ATV, or with dealer incentives or credits.

Step Two: Find the Interest Rate

The interest rate is the cost you pay to borrow the money for the loan. It’s usually expressed as an annual percentage rate (APR). Interest rates can vary by loan type, lender, your credit score, and market conditions.

Step Three: Find the Loan Term

The loan term is the duration of the loan and the amount of time you agree to make regular payments to the lender to repay the loan. Common terms for ATV loans range from 24 to 60 months, but may be shorter or longer, depending on the lender.

Step Four: Determine the Monthly Payment

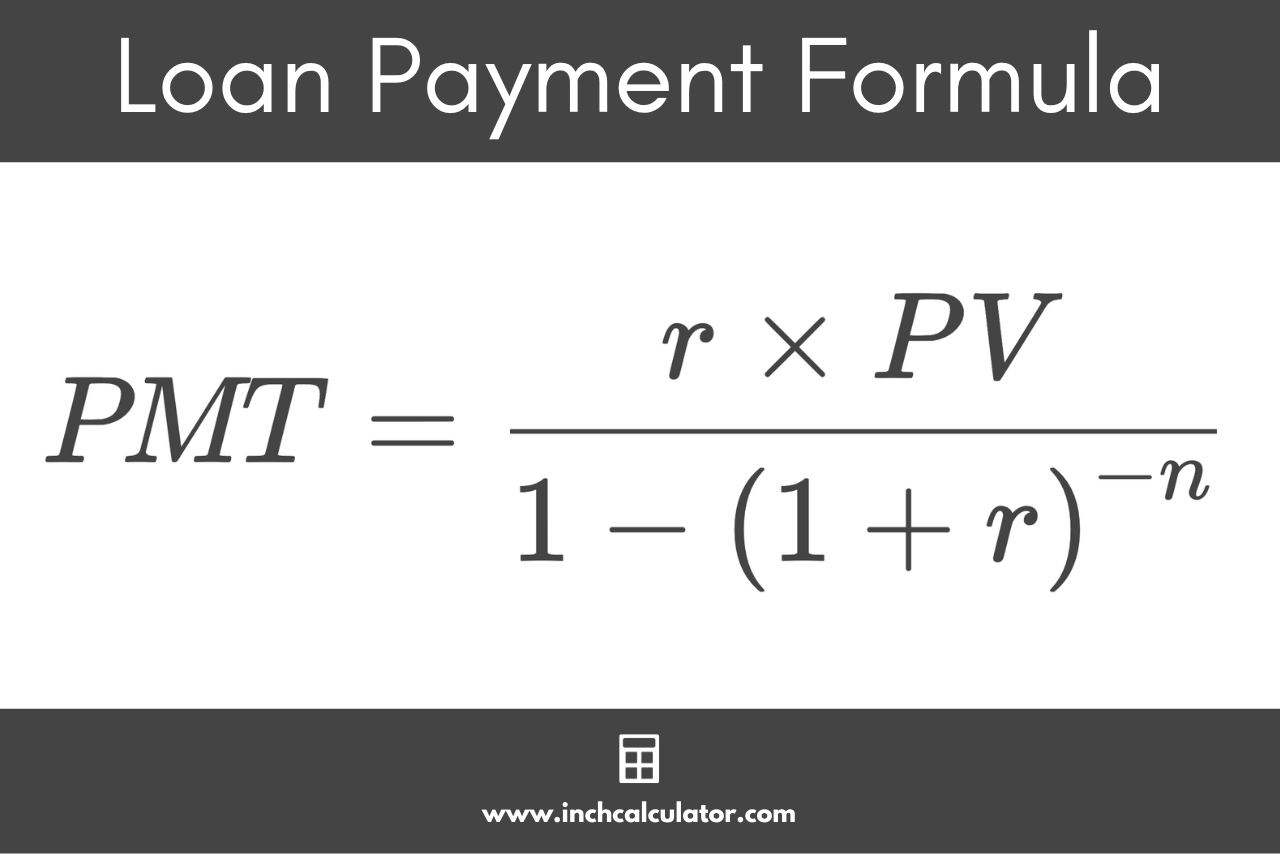

You can calculate the monthly payment for an ATV using the same method as figuring the payment for auto or motorcycle loans. The loan payment formula is:

Where:

PMT = monthly payment

PV = loan amount

r = interest rate

n = number of payments

By substituting the loan amount, interest rate, and loan term in months into the formula above, you can calculate the monthly payment for an ATV loan.

You can also use this formula to figure out the payment for a boat or RV loan.

Step Five: Consider for Additional Costs

There are often additional fees that are included in a loan in addition to the cost of the ATV or machine.

These can include registration, insurance, maintenance, and licensing fees. Buying a good helmet and other safety equipment is often required and a good idea as well. These often do not change the loan payment, but they may impact your overall budget and the total cost of ownership.