Motorcycle Loan Calculator

Calculate the payment for a motorcycle loan using the loan calculator below.

Motorcycle Loan Summary:

| Monthly Payment: | $300.05

|

| Loan Amount: | $15,900.00

|

| Total Interest: | $2,103.21

|

| Total Payments: | $18,003.21

|

| Payoff Date: | May 2030

|

Amortization Schedule:

| Date | Payment | Principal | Interest | Remaining Balance |

|---|---|---|---|---|

| May 2025 | $300.05 | $233.80 | $66.25 | $15,666.20 |

| Jun 2025 | $300.05 | $234.77 | $65.28 | $15,431.43 |

| Jul 2025 | $300.05 | $235.75 | $64.30 | $15,195.68 |

| Aug 2025 | $300.05 | $236.73 | $63.32 | $14,958.95 |

| Sep 2025 | $300.05 | $237.72 | $62.33 | $14,721.23 |

| Oct 2025 | $300.05 | $238.71 | $61.34 | $14,482.52 |

| Nov 2025 | $300.05 | $239.71 | $60.34 | $14,242.81 |

| Dec 2025 | $300.05 | $240.70 | $59.35 | $14,002.11 |

| Jan 2026 | $300.05 | $241.71 | $58.34 | $13,760.40 |

| Feb 2026 | $300.05 | $242.71 | $57.34 | $13,517.69 |

| Mar 2026 | $300.05 | $243.73 | $56.32 | $13,273.96 |

| Apr 2026 | $300.05 | $244.74 | $55.31 | $13,029.22 |

| May 2026 | $300.05 | $245.76 | $54.29 | $12,783.46 |

| Jun 2026 | $300.05 | $246.79 | $53.26 | $12,536.67 |

| Jul 2026 | $300.05 | $247.81 | $52.24 | $12,288.86 |

| Aug 2026 | $300.05 | $248.85 | $51.20 | $12,040.01 |

| Sep 2026 | $300.05 | $249.88 | $50.17 | $11,790.13 |

| Oct 2026 | $300.05 | $250.92 | $49.13 | $11,539.21 |

| Nov 2026 | $300.05 | $251.97 | $48.08 | $11,287.24 |

| Dec 2026 | $300.05 | $253.02 | $47.03 | $11,034.22 |

| Jan 2027 | $300.05 | $254.07 | $45.98 | $10,780.15 |

| Feb 2027 | $300.05 | $255.13 | $44.92 | $10,525.02 |

| Mar 2027 | $300.05 | $256.20 | $43.85 | $10,268.82 |

| Apr 2027 | $300.05 | $257.26 | $42.79 | $10,011.56 |

| May 2027 | $300.05 | $258.34 | $41.71 | $9,753.22 |

| Jun 2027 | $300.05 | $259.41 | $40.64 | $9,493.81 |

| Jul 2027 | $300.05 | $260.49 | $39.56 | $9,233.32 |

| Aug 2027 | $300.05 | $261.58 | $38.47 | $8,971.74 |

| Sep 2027 | $300.05 | $262.67 | $37.38 | $8,709.07 |

| Oct 2027 | $300.05 | $263.76 | $36.29 | $8,445.31 |

| Nov 2027 | $300.05 | $264.86 | $35.19 | $8,180.45 |

| Dec 2027 | $300.05 | $265.96 | $34.09 | $7,914.49 |

| Jan 2028 | $300.05 | $267.07 | $32.98 | $7,647.42 |

| Feb 2028 | $300.05 | $268.19 | $31.86 | $7,379.23 |

| Mar 2028 | $300.05 | $269.30 | $30.75 | $7,109.93 |

| Apr 2028 | $300.05 | $270.43 | $29.62 | $6,839.50 |

| May 2028 | $300.05 | $271.55 | $28.50 | $6,567.95 |

| Jun 2028 | $300.05 | $272.68 | $27.37 | $6,295.27 |

| Jul 2028 | $300.05 | $273.82 | $26.23 | $6,021.45 |

| Aug 2028 | $300.05 | $274.96 | $25.09 | $5,746.49 |

| Sep 2028 | $300.05 | $276.11 | $23.94 | $5,470.38 |

| Oct 2028 | $300.05 | $277.26 | $22.79 | $5,193.12 |

| Nov 2028 | $300.05 | $278.41 | $21.64 | $4,914.71 |

| Dec 2028 | $300.05 | $279.57 | $20.48 | $4,635.14 |

| Jan 2029 | $300.05 | $280.74 | $19.31 | $4,354.40 |

| Feb 2029 | $300.05 | $281.91 | $18.14 | $4,072.49 |

| Mar 2029 | $300.05 | $283.08 | $16.97 | $3,789.41 |

| Apr 2029 | $300.05 | $284.26 | $15.79 | $3,505.15 |

| May 2029 | $300.05 | $285.45 | $14.60 | $3,219.70 |

| Jun 2029 | $300.05 | $286.63 | $13.42 | $2,933.07 |

| Jul 2029 | $300.05 | $287.83 | $12.22 | $2,645.24 |

| Aug 2029 | $300.05 | $289.03 | $11.02 | $2,356.21 |

| Sep 2029 | $300.05 | $290.23 | $9.82 | $2,065.98 |

| Oct 2029 | $300.05 | $291.44 | $8.61 | $1,774.54 |

| Nov 2029 | $300.05 | $292.66 | $7.39 | $1,481.88 |

| Dec 2029 | $300.05 | $293.88 | $6.17 | $1,188.00 |

| Jan 2030 | $300.05 | $295.10 | $4.95 | $892.90 |

| Feb 2030 | $300.05 | $296.33 | $3.72 | $596.57 |

| Mar 2030 | $300.05 | $297.56 | $2.49 | $299.01 |

| Apr 2030 | $300.26 | $299.01 | $1.25 | $0.00 |

On this page:

How to Calculate a Motorcycle Loan Payment

When you’re in the market for a new motorcycle, understanding how to calculate your loan payment is crucial. This not only helps you budget accordingly but also ensures you are not overextending your finances.

Three factors are used to determine the payment for a new bike: the loan amount, interest rate, and loan term. You can calculate the payment in a few steps.

Step One: Determine the Loan Amount

The loan amount is the total amount of money you borrow to purchase the motorcycle. This might include the price of the bike itself, any additional accessories, taxes, and loan fees. The loan amount can be reduced by making a down payment or trading in a used motorcycle.

Step Two: Determine the Interest Rate

The interest rate is the cost you pay to borrow the money, usually expressed as an annual percentage rate (APR). Interest rates vary depending on the lender, your credit score, and market conditions. Having a higher credit score often allows you to qualify for a lower interest rate, which means lower payments.

Step Three: Determine the Loan Term

The loan term is the length of time you agree to pay back the loan, and is typically expressed in months. Common terms for motorcycle loans range from 24 to 60 months.

Loans with a longer term often offer lower monthly payments, but require more interest to be paid over time.

Step Four: Calculate the Monthly Payment

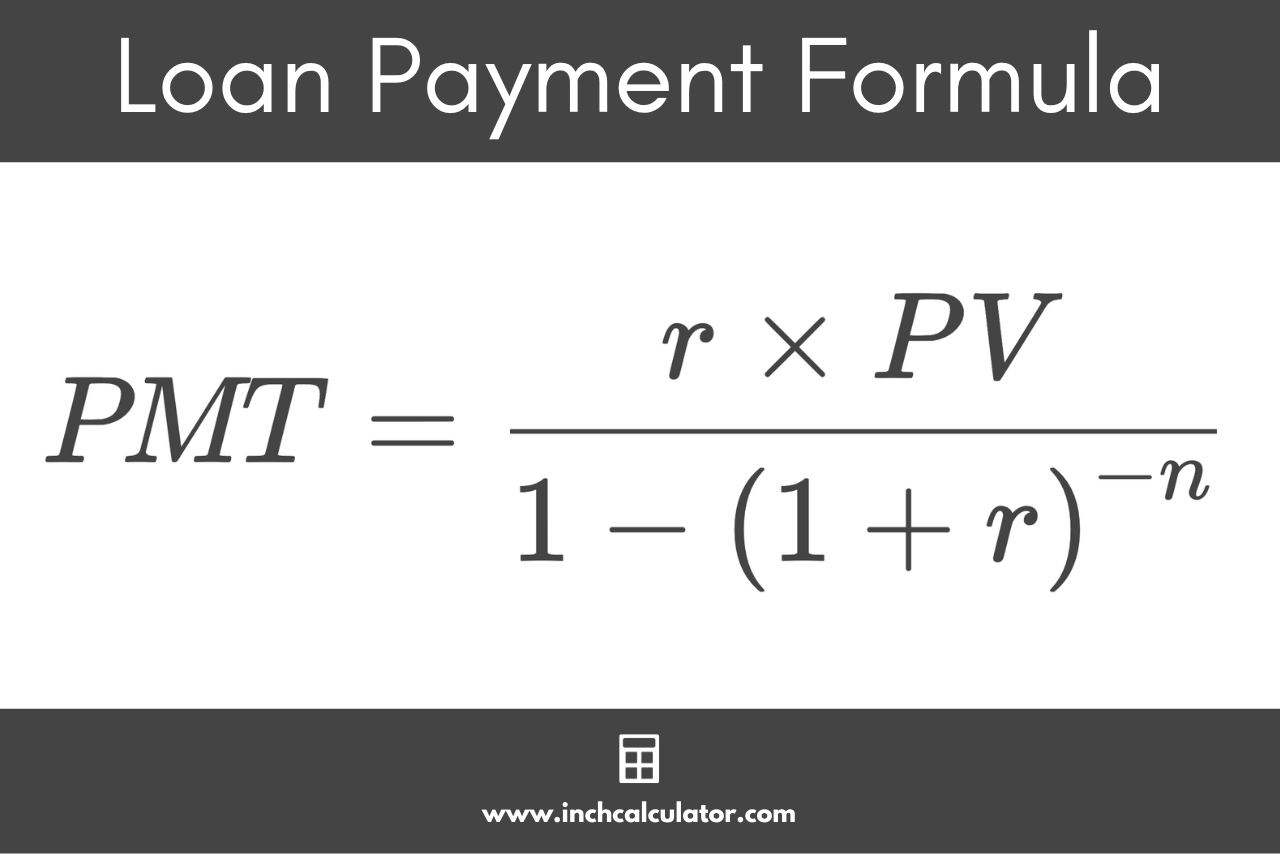

To calculate the monthly payment, you can use the formula for an installment loan:

Where:

PMT = monthly payment

PV = loan amount

r = interest rate

n = number of payments

Step Five: Account for Additional Costs

Owning a motorcycle often requires additional fees and costs that may not be included in the loan payment. These may include insurance, maintenance, repairs, and registration fees. Buying a good helmet and other riding gear will keep you safe from the prevailing weather conditions and any incidents that may happen on the road or the trail.

While these may not affect the loan payment directly, they can impact your overall budget and the cost of owning a motorcycle each month.

Calculating the payment for a motorcycle loan is the same as calculating the payment for a car, boat, RV, or ATV.

Frequently Asked Questions

What types of loans are available for motorcycles?

There are secured motorcycle loans, which are backed by collateral (the motorcycle acts as collateral for the loan). This means that in the event that you do not make the loan payments, your motorcycle may be repossessed to cover the cost of the missed payments.

There are also unsecured motorcycle loans, which are similar to personal loans. Unsecured loans are not backed by collateral, which means that the interest rate may be higher than with a secured loan. While the motorcycle may not be repossessed in the event that you default on the payments, your credit score will take a big hit, making it very difficult for you to borrow money for any future needs.

How can you get a good interest rate on a motorcycle loan if you don't have a great credit score?

There are a few ways to improve your chances of getting a motorcycle loan with the lowest possible interest rate:

Save up more for a down payment: The more money you can put down, the less of a risk the lender must take in giving you a motorcycle loan. Doing this will also reduce your monthly payment and could get you a lower interest rate on the loan.

Improve your credit score: A higher credit score means lower interest rates when you apply for a motorcycle loan. Some ways to do this are to always make your payments on time, along with keeping your credit card balances low or paying them off entirely.

Shop around for the best motorcycle loan deal: Find out what type of loan you can get from dealers, banks, and credit unions in your area. Compare interest rates, how much you must put down, and any other details. Take your best deal from a financial institution to your dealer and see if they can do any better.

Consider a cosigner on your motorcycle loan: If your credit is not good enough to get a decent motorcycle loan, you could ask someone you know who has better credit to cosign your loan. The cosigner will be responsible for making the payments if you do not, so make sure that anyone you ask to cosign understands this clearly.

What other costs should you consider when getting a motorcycle loan?

Your monthly motorcycle payment is only the first and largest part of your motorcycle-related costs. You will also need to pay for insurance coverage, fuel, required maintenance, any necessary repairs, worn tires over time, and so on.

Plus, you must budget for the riding gear you will need to stay safe and protect yourself from the elements, as well as any incidents that may happen as you ride. This includes a good quality helmet, a face shield, or other type of eye protection, along with gloves, boots, a jacket, and pants that are designed for motorcycle use.

Some dealers may sell this gear and be able to include it in your motorcycle loan. If you are getting a loan from a bank or a credit union, ask if the cost of the gear can be included in the loan. Make sure that your budget has room to cover all of these additional expenses – before you commit to purchasing a motorcycle with a loan.